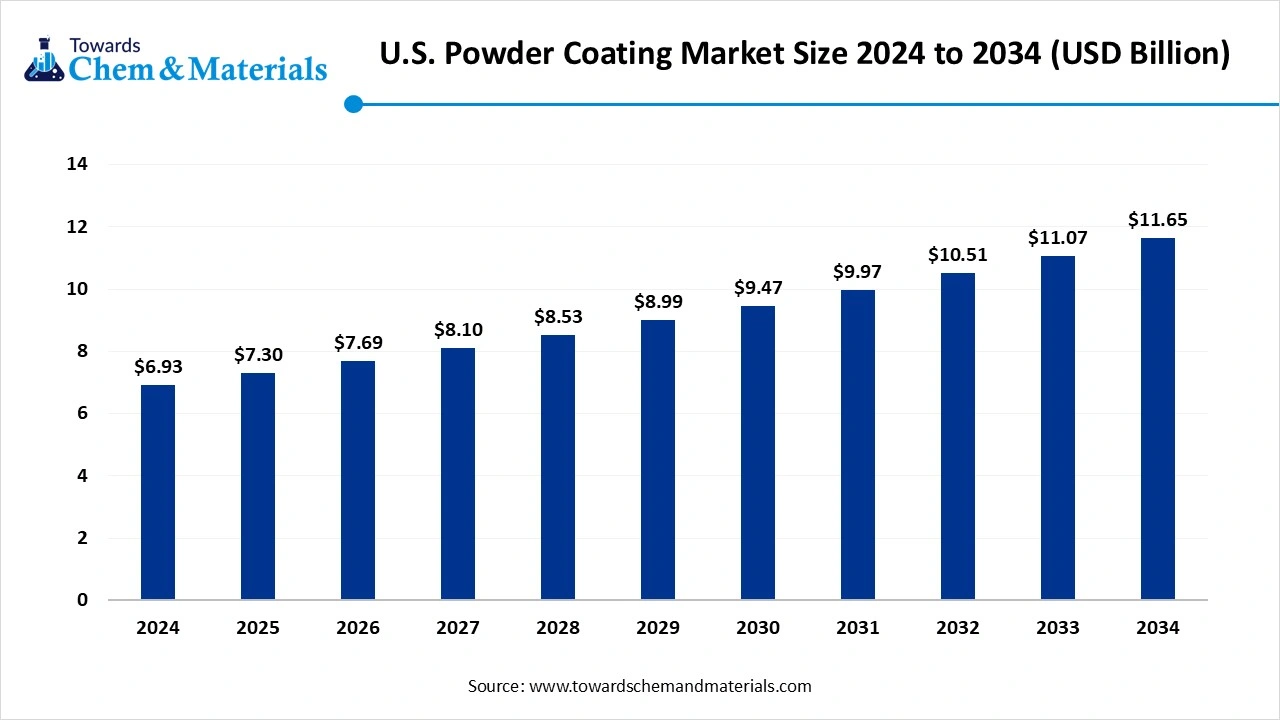

U.S. Powder Coatings Market Size to Cross USD 11.65 Bn by 2034

According to Towards Chemical and Materials, the U.S. powder coatings market size is calculated at USD 7.30 billion in 2025 and is expected to be worth around USD 11.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.33% over the forecast period 2025 to 2034.

Ottawa, Oct. 13, 2025 (GLOBE NEWSWIRE) -- The U.S. powder coatings market size was valued at USD 6.93 billion in 2024 and is anticipated to reach around USD 11.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.33% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The Rising demand for durable and eco-friendly coatings in the automotive and construction industries is driving the growth of the market.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5868

U.S. Powder Coatings Overview

The U.S. powder coatings market is witnessing robust growth, driven by rising environmental awareness, advancements in coatings technologies, and a string shift toward sustainable manufacturing practices. The market continues to expand as industries increasingly favour powder coatings for their superior durability, high performance, and eco-friendly characteristics compared to conventional liquid coatings. Demand is particularly high in sectors such as automotive, appliances, architecture, and general industrial applications, where corrosion resistance, chemical stability, and aesthetic appeal are key performance parameters.

The Manufacturers are focusing on developing advanced formulations that deliver improved adhesion, faster enhanced resistance to weathering, while complying with stringent environmental regulations limiting volatile organic compound emissions. The growing popularity of low-temperature cure and thin film technologies also enabling powder coatings to penetrate new application areas, including heat sensitive substrates. In addition, the market is supported by technological innovation, rising investments in automation and energy efficient coating systems, and strategic initiates by leading producers to expand production capacities across the I.S. to address the rising domestic and export demand.

U.S. Powder Coatings Market Report Highlights

- By resin/ chemistry, the polyester (TGIC-free) segment dominated the market in 2024. The polyester (TGIC-free) segment held approximately 37% share in the market in 2024. These coatings are widely used in architectural, automotive, and general industrial applications.

- By application technology, the electrostatic spray (corona) segment dominated the market in 2024. The electrostatic spray (corona) segment held approximately 62% share in the market in 2024. The technique ensures uniform coverage, reduced material waste, and strong adhesion on complex geometries.

- By cure temperature, the medium cure (140–180 °c) segment dominated the market in 2024. The medium cure (140–180 °c) segment held approximately 55% share in the market in 2024. These formulations are widely used in appliances, architectural products, and industrial equipment.

- By end-use industry, the appliances / white goods segment dominated the market in 2024. The appliances / white goods segment held approximately 22% share in the market in 2024. The demand for enhancing aesthetic appeal drives the growth of the market.

- By distribution channel, the direct sales segment dominated the market in 2024. The direct sales segment held approximately 50% share in the market in 2024. Direct sales allow companies to engage in collaborative product development.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/checkout/5868

U.S. Powder Coatings Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 7.69 Billion |

| Revenue forecast in 2034 | USD 11.65 Billion |

| Growth rate | CAGR of 5.33% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in Kilotons, Revenue in USD million and CAGR from 2025 to 2034 |

| Report coverage | Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Resin / Chemistry, By Application Technology, By Cure Temperature, By End-Use IndustryBy Distribution Channel |

| Key companies profiled | PPG Industries, The Sherwin-Williams Company, Axalta Coating Systems, AkzoNobel, BASF, Asian Paints, Kansai Paint, Jotun, Allnex, Mankiewicz Coatings, Teknos Group, Tiger Coatings, Prismatic Powders, Hentzen Coatings, RPM International, Valspar (Sherwin-Williams), Allied Powder Coatings, Europowder, ICI Powder Coatings, Cardinal Paints |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Powder Coating Process: How are they Manufactured?

The established manufacturing process for powder coatings comprises the following steps:

- The raw powder coating materials are generally mixed dry. This process is called dry blending.

- The blended raw materials are then fed into an extruder. This step takes place at elevated temperatures to mill the pigments and for melt mixing to achieve a homogenous mix.

- The extrudate is then cooled rapidly.

- Milling the flakes of an extrudate into chips to a final size in a multi-stage process. The chips are ground to a very specific particle size distribution depending on the application.

- Removing undersize and oversize particles.

Limitations of powder coating process

To avoid manufacturing mishaps, you should consider the following limitations while creating powder coating formulations.

- Liquid additives (including pigment dispersants) cannot be used unless first converted to a solid form.

- Shearing time equals the dwell time in the extruder - typically around 20 seconds - with no opportunity to extend dispersion time or control it independently; the shear is inadequate for some types of pigments and too much for many effect pigments.

- Care must be taken to ensure that extruder temperatures are low enough to avoid premature crosslinking. Various proposals have been put forward for processes which avoid these problems, but they have not so far had a major impact.

- The particle size is important to the performance and appearance of the coating. The size of the powder particle can have an influence on the behavior of the material in the delivery system, charging systems, and the final film characteristics.

- When reclaimed powder is used, the coater must maintain a consistent particle size distribution. There are several methods by which particle size distribution can be measured.

The Main Uses of Epoxy Powder Coating

Because it’s resistant to harsh chemicals and corrosion, epoxy powder coating is ideal for a variety of products in multiple industries:

- Appliances: Household goods, such as washing machines, dryers, microwaves, refrigerators and stoves, frequently come in contact with water and cleaning products. As a result, they receive epoxy powder coating in combination with polyester resins, titanium dioxide and barium sulfate to give them their long-lasting white appearance.

- Automotive items: The industry uses powder coating as both a base coat and a finish, especially with underbody and under-hood parts that experience heat, stress, corrosion, and elemental wear and tear.

- Construction: Steel rebars, pillars and poles that are used in structures, as well as hand and power tools and wires, are coated with epoxy powder.

- Industrial furniture: Epoxy powder coating can protect industrial furniture, like metal cabinets, hardware features and even toolboxes, from exposure to cooling, lubrication and cleaning.

- Marine structures: The anti-corrosion properties work well for underwater structures and vehicles, such as marine vessels.

- Medical equipment: Staff use hospital beds, examination tables and equipment stands on a regular basis, which can be protected from long-term use with epoxy powder coating.

- Plumbing systems: Plumbing systems with epoxy-based powder coating are corrosion-resistant.

- Public transportation: As bars and handles inside buses and trains are more prone to wear and tear from people’s touch, adding epoxy powder coating can help protect these parts and preserve their color.

- Sports equipment: Epoxy powder coating can protect sports and recreation equipment from long-term use.

- Vending machines: People use vending machines many times a day, so they often come with a protective epoxy powder coating around the panels and components to increase their life span.

What Are The Major Trends In The U.S. Powder Coatings Market ?

- Rising emphasis on sustainability and low-VOC/ solvent free formulations is pushing adoption of powder coatings over liquid alternatives.

- Development of low temperature cure and energy-efficient curing technologies to broaden substrate compatibility and reduce energy consumption.

- Growing use of powder coatings in architectural and building products driven by demand for durable, weather resistant finishes.

- Expansion of digital and e-commerce channel, improving accessibility and supply chain flexibility for powder coating products.

How Does AI Influence The Growth Of The U.S. Powder Coatings Market In 2025?

In 2025, AI is accelerating the U.S. powder coatings market by enabling adaptive spray control that tunes coatings parameters in real time to reduce overspray and ensure uniform deposition, integrating predictive maintenance systems that foresee equipment failures and minimize downtime, and powering closed loop optimization tools that analyse thickness and surface feedback to auto adjust process conditions for quality assurance and resource efficiency.

How Is The U.S. regionally Segmented In Powder Coatings Demand?

U.S. dominated dominates the market in the U.S. powder coatings consumption concentrates in highly industrialized and manufacturing hubs where sectors like appliances, automotive components, and architectural produced, with coastal and rust belt states acting as focal points of demand sue to proximity to OEMs and infrastructure projects. Geographic clusters around the Southeast and Midwest benefit from integrated supply chains and lower logistics costs for raw materials and finished goods, giving them competitive advantage in coating operations. Manufacturers often locate plants near major markets or access to ports to facilitate export and import of resins, pigments, and equipment.

U.S. Powder Coatings Market Segmentation Insights

Resin/Chemistry Insights

Which Resin Segment Is Dominating In U.S. Powder Coatings Market?

The polyester (TGIC- Free) segment captured the largest portion of the market in 2024. This segment remains highly preferred due to its exceptional durability, resistance to corrosion, and ability to provide a smooth, high quality finish on a wide range of metal substrates. Its widespread adoption across automotive, appliance, and architectural applications reflects its versatility and reliability, making it a staple for manufacturers seeking consistent performance. Additionally, the polyester (TGIC-free) formulations comply with stricter environmental regulations, which further enhances their acceptance in markets focused on sustainability and low VOC emissions.

The polyurethane segment id projected to experience the highest growth rate in the market between 2025 and 2034. Polyurethane powders are valued for their exceptional flexibility, chemical resistance, and ability to produce vibrant, durable finishes. They are increasingly used in high end architectural, automotive, and industrial applications where performance under stress and weather exposure is critical. Advancements in low temperature curing and environmentally friendly formulations further enhance their appeal.

Application Technology Insights

Which Application Is Dominating In U.S. Powder Coatings Market?

The electrostatic (corona) segment dominated the market in 2024. This method is preferred for its efficiency in depositing a uniform coating on various metal surfaces, ensuring minimal waste and high quality finishes. Electrostatic spray technology is highly adaptable for large scale production lines in appliances, automotive, and industrial machinery. The system’s ability to provide precise control over coating thickness and adherence enhances product durability while reducing operational costs. Manufacturers rely on this method for its compatibility with multiple resin types and its proven reliability, solidifying its dominant position in the U.S. market.

The fluidized bed segment is expected to grow at the fastest rate during the forecast period. Fluidized bed technology is effective for coating irregular shapes and providing thick, uniform layers on metal parts. Its precision and efficiency make it ideal for automotive, industrial machinery, and specialty metal products. Automation and process improvements are accelerating adoption, as manufacturers can achieve higher throughput and consistent quality. This technology’s ability to meet modern production demands ensures its rapid growth in the U.S. powder coatings market.

Cure Temperature Insights

Which Cure Temperature Is Dominating In U.S. Powder Coatings Market?

The medium cure (140-180˚C) segment maintained a leading position in the market in 2024. Medium-temperature curing provides a balanced approach, allowing high quality finishes without excessive energy consumption, making it suitable for metal appliances, automotive components, and furniture. This range supports optimal cross linking of polyester and epoxy based powders, ensuring mechanical and chemical resistance. Its versatility in handling different substrates types and thicknesses make it widely adopted by manufacturers focused on reliability and operational efficiency.

The low temperature cure segment is anticipated to grow with the highest CAGR in the studied years. Low-temperature curing expands the usability of powder coatings to heat sensitive subtracts like plastics, composites, and thin metals. Manufacturing benefit from energy savings and reduced production costs while maintaining coating performance and durability. The segment also allows for innovations in hybrid formulations and eco-friendly powders.

End Use Industry Insights:

Which End Use Industry Is Dominating In U.S. Powder Coatings Market?

The appliances/white goods segment dominated the market in 2024. This segment relies heavily on powder coatings to provide long lasting, scratch-resistant, and visually appealing finishes on refrigerators, washing machines, ovens, and other household appliances. Powder coatings enhance durability against daily wear, heat and moisture, which are common in household use. Manufacturers in this sector prioritize coatings that meet both aesthetic expectations and environmental regulations. The combination of high demand for consumer appliances and the need for durable, eco-friendly finishes ensures that this industry segment remains central to the market.

The architectural and building products segment is projected to expand rapidly in the coming years. Powder coatings provide corrosion resistance, aesthetic finishes and weather durability on aluminium, steel and other building materials used in facades, panel, doors and windows. Growing construction activity and demand for sustainable, low maintenance building products are fuelling adoption. Manufacturers are increasingly leveraging powder coatings for energy efficient and visually appealing finishes, supporting industry growth.

Distribution Channel Insights

Which Distribution Channel Is Dominating In U.S. Powder Coatings Market?

The direct sales segment held the largest share in the market in 2024. Direct engagement with manufacturers allows for tailored service, timely delivery, and technical support for powder coatings products. Companies benefit from reduced intermediaries, stronger relationships, and better integration with production schedules. Direct sales also facilitate quick feedback loops, enabling manufacturers to adjust formulations and services according to client requirements.

The online/ e-commerce segment is predicted to witness significant growth over the forecast period. Online sales provide easy access to powder coatings for small and medium-sized manufacturers, offering convenience, wider product coatings for small and medium-sized manufacturers, offering convenience, wider product selection, and faster delivery. The digital platform also supports technical guidance, training, and product customization, enhancing customer experience. This distribution method is gaining popularity as companies embrace digital transformation in procurement and logistics.

U.S. Powder Coatings Market Top Companies

-

PPG Industries

- One of the top U.S. powder coating suppliers.

- Offers a wide range of powder products (epoxy, polyester, hybrid).

- Invested heavily in U.S. production capacity and e-commerce access.

-

The Sherwin-Williams Company

- Major player in U.S. industrial and architectural powder coatings.

- Offers sustainable, low-VOC solutions (e.g. Powdura® Eco).

- Strong domestic distribution and OEM relationships.

-

Axalta Coating Systems

- Key U.S. supplier of powder coatings, especially for automotive and general industrial use.

- Offers brands like Alesta®, Nap-Gard®.

- Known for corrosion resistance and custom color matching.

-

AkzoNobel

- Global leader with strong U.S. presence via Interpon® powder coatings.

- Focuses on architectural, general industrial, and consumer goods sectors.

- Invests in R&D for low-temp and UV-cured powders.

-

BASF

- Does not sell powder coatings directly but supplies essential resins, crosslinkers, and additives.

- Key enabler of high-performance powder formulations in the U.S.

- Focused on sustainability and innovation at the raw material level.

-

Asian Paints

- Limited direct presence in U.S. powder coatings.

- Focused mainly on Asian markets.

- May participate indirectly via joint ventures (e.g., Asian Paints PPG).

-

Kansai Paint

- Expanding in North America; building a major powder coatings plant in Ohio.

- Traditionally strong in Asia; entering U.S. market gradually.

- Targets industrial and automotive segments.

-

Jotun

- Primarily known for protective and marine coatings.

- Limited direct involvement in U.S. powder coatings.

- Active in niche or infrastructure projects.

-

Allnex

- Major global supplier of powder coating resins and additives.

- Indirect but crucial role in U.S. powder coating product development.

- Enables formulation of high-durability and low-cure powders.

-

Mankiewicz Coatings

- Niche player with U.S. operations (Charleston, SC).

- Supplies high-end industrial coatings; limited powder coating lines.

- Focuses on custom and specialty coatings (e.g. aerospace, rail, medical devices).

More Insights in Towards Chemical and Materials:

- Powder Coatings Market : The global powder coatings market size was valued at USD 17.25 billion in 2024 and is estimated to hit around USD 30.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% during the forecast period 2025 to 2034.

- Sustained Release Coatings Market : The global sustained release coatings market size was reached at USD 675.85 million in 2024 and is expected to be worth around USD 1,373.63 million by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period 2025 to 2034.

- Self-Healing Coatings Market : The global self-healing coatings market size accounted for USD 3.21 billion in 2024 and is predicted to increase from USD 4.12 billion in 2025 to approximately USD 39.16 billion by 2034, expanding at a CAGR of 28.42% from 2025 to 2034.

- Automotive OEM Coatings Market : The global automotive OEM coatings market size was valued at USD 16.35 billion in 2024, grew to USD 25.25 billion in 2025, and is expected to hit around USD 25.25 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.44% over the forecast period from 2025 to 2034.

- U.S. Conformal Coatings Market : The U.S. conformal coatings market size was valued at USD 1.86 billion in 2024, grew to USD 1.96 billion in 2025, and is expected to hit around USD 3.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.44% over the forecast period from 2025 to 2034.

- U.S. Paints & Coatings Market : The U.S. paints & coatings market size was reached at USD 32.19 billion in 2024 and is expected to be worth around USD 50.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period 2025 to 2034.

- Low-VOC Coatings Market : The global low-VOC coatings market size was reached at USD 8.75 billion in 2024 and is expected to be worth around USD 15.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034.

- Nanocoatings Market ; The global nanocoatings market size accounted for USD 16.93 billion in 2024 and is predicted to increase from USD 20.10 billion in 2025 to approximately USD 94.40 billion by 2034, expanding at a CAGR of 18.75% from 2025 to 2034.

- Functional Coatings Market : The global functional coatings market volume was reached at 7.95 million tons in 2024 and is expected to be worth around 13.14 million tons by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

- Wood Coatings Market : The global wood coatings market size was valued at USD 12.09 billion in 2024 and is expected to reach around USD 20.36 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

- Green Coatings Market : The global green coatings market size was reached at USD 137.83 billion in 2024 and is estimated to surpass around USD 224.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.99% during the forecast period 2025 to 2034.

- Concrete Floor Coatings Market : The global concrete floor coatings market size was valued at USD 5.07 billion in 2024 and is expected to reach around USD 8.53 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

- Flat Glass Coatings Market ; The global concrete floor coatings market size was reached at USD 3.91 billion in 2024 and is estimated to reach around USD 14.75 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.20% during the forecast period 2025 to 2034.

- Pipe Coatings Market : The global pipe coatings market size was valued at USD 9.95 billion in 2024 and is growing to approximately USD 16.84 billion by 2034, with a developing compound annual growth rate (CAGR) of 5.40% over the forecast period 2025 to 2034.

- U.S. Diamond Coatings Market : The U.S. diamond coatings market volume was reached at 508.12 tons in 2024 and is expected to be worth around 945.31 tons by 2034, growing at a compound annual growth rate (CAGR) of 6.40% over the forecast period 2025 to 2034.

- U.S. Mirror Coatings Market : The U.S. mirror coatings market size was valued at USD 185.19 million in 2024, grew to USD 194.65 million in 2025, and is expected to hit around USD 304.83 million by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period from 2025 to 2034.

- European Paints & Coatings Market : The European paints & coatings market size is calculated at USD 38.66 billion in 2024, grew to USD 39.99 billion in 2025, and is projected to reach around USD 54.27 billion by 2034. The market is expanding at a CAGR of 3.45% between 2025 and 2034.

- U.S. Industrial Coatings Market : The U.S. industrial coatings market size accounted for USD 28.19 billion in 2024 and is predicted to increase from USD 29.11 billion in 2025 to approximately USD 38.81 billion by 2034, expanding at a CAGR of 3.25% from 2025 to 2034.

U.S. Powder Coatings Market Top Key Companies:

- PPG Industries

- The Sherwin-Williams Company

- Axalta Coating Systems

- AkzoNobel

- BASF

- Asian Paints

- Kansai Paint

- Jotun

- Allnex

- Mankiewicz Coatings

- Teknos Group

- Tiger Coatings

- Prismatic Powders

- Hentzen Coatings

- RPM International

- Valspar (Sherwin-Williams)

- Allied Powder Coatings

- Europowder

- ICI Powder Coatings

- Cardinal Paints

Recent Developments

- In October 2025, Private equity firm Carlyle is reportedly in exclusive negotiations to acquire BASF’s coatings division, valued at approximately €7 billion. The division, primarily focused on automotive coatings, employs over 10,000 people. This potential acquisition is part of BASF’s broader restricting strategy to streamline operations and enhance capital allocation.

- In April 2024, the powder coatings industry is witnessing growth driven by advancements in technology and materials science. Innovations are enabling the development of coatings that meet both sustainability and performance criteria, creating a dynamic environment for rapid industry shifts.

U.S. Powder Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global U.S. Powder Coatings Market

By Resin / Chemistry

- Polyester (TGIC-free)

- Polyester (TGIC-containing)

- Epoxy

- Epoxy-Polyester Hybrid

- Polyurethane (Polyester-Urethane)

- Acrylic

- Fluoropolymer

- Nylon

- Others (phenolic, silicone, polyolefin)

By Application Technology

- Electrostatic Spray (Corona)

- Electrostatic Spray (Tribo)

- Fluidized Bed Dipping

By Cure Temperature

- Low-Temperature Cure (<140 °C)

- Medium-Temperature Cure (140–180 °C)

- High-Temperature Cure (>180 °C)

By End-Use Industry

- Automotive & Transportation

- Appliances / White Goods

- Architectural & Building Products

- Furniture

- General Industrial Manufacturing

- Agricultural & Construction Equipment

- Oil & Gas / Energy

- Marine & Offshore

- Electrical & Electronics

- Medical Devices & Equipment

- Consumer Goods

- Packaging & Drums

By Distribution Channel

- Direct Sales (to OEMs)

- Distributors (national/regional/local)

- Online / E-commerce

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5868

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.